Funding and credit rating

Statkraft is not a publicly listed company and is thus primarily financed through cash flow from activities, supplemented by external loans.

Statkraft’s external financing is achieved primarily through the issue of bonds and commercial papers in the NOK, SEK and EUR markets. Statkraft AS has an EMTN programme registered on the Irish Stock Exchange plc (Euronext Dublin), with standard documentation for all financing. New bonds are listed primarily in Oslo or Dublin.

Statkraft AS is the group’s parent company. Statkraft AS is wholly owned by Statkraft SF, which is wholly owned by the Ministry of Trade, Industry and Fisheries.

Finance strategy

The main funding strategy is to centralise external funding at Statkraft AS level. This means that Statkraft AS will be the borrower of bank loans and issuer of debt instruments in the capital market. Statkraft issues debt primarily under its EUR 9.0 billion Euro Medium Term Note Programme. The group shall maintain liquid reserves sufficient to operate the business for six months without issuing new debt.

The group holds an unused committed revolving facilities of EUR 1.3 billion which matures in 2029. The facility was refinanced in March 2022.

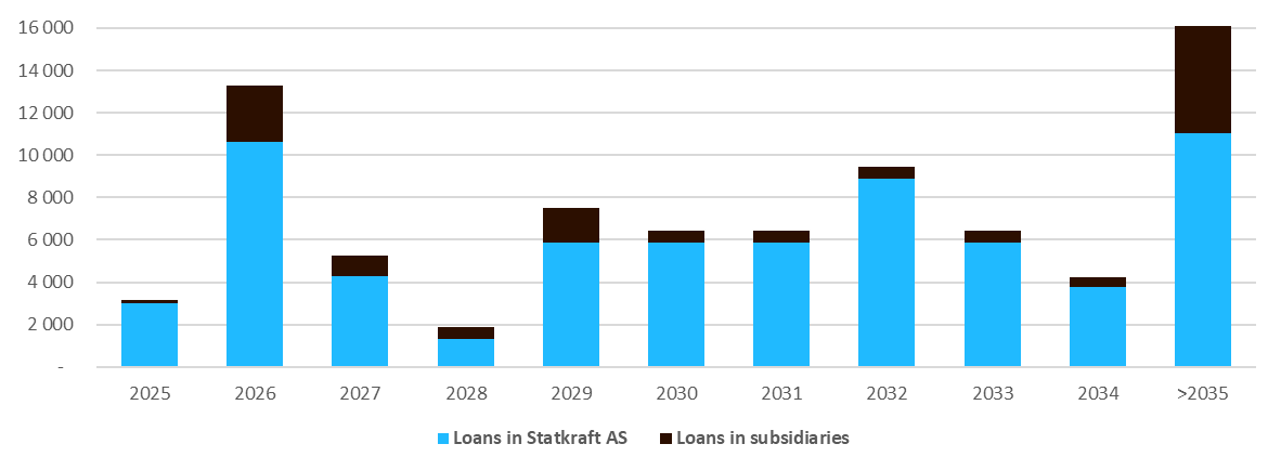

The tenor of any new bond issued shall meet the need for long-term financing and ensure evenly distributed debt redemption profile.

All lenders are treated equally through pari passu clauses and negative pledge agreements in the loan contracts. Restrictions have been imposed on the subsidiaries’ capacity to borrow in their own right.

Statkraft’s target is to be a leading international renewable energy company, creating value by enabling a net-zero future. The strategy is built on creating value along four strategic pillars.

-

-

Offering circular

Offering circular

-

-

-

-

-

-

-

-

Offering Circular 2019

Offering Circular

-

-

-

Offering Circular 2018

Offering Circular

-

-

-

Offering Circular 2017

Offering Circular

-

-

-

Offering Circular 2016

Offering Circular -

Supplement/Final terms 2016

16 March 2017 (Final Terms)03 March 2017 (Supplement)17 January 2017 (Supplement)19 August 2016 (Supplement)

-

-

-

Offering Circular 2015

Offering Circular

-

-

-

Offering Circular 2014

Offering Circular -

Supplement/Final Terms 2014

24 March 2015 (Final Terms)13 March 2015 (Supplement)18 December 2014 (Supplement)16 January 2015 (Final Terms)

-

-

-

Offering Circular 2013

Offering Circular

-

-

-

-

Offering Circular 2011

Offering Circular

-

-

-

Offering Circular 2010

Offering Circular

-

-

-

Offering Circular 2009

Offering Circular

-

-

-

Offering Circular 2008

Offering Circular

-

-

-

Offering Circular 2007

Offering Circular

-

-

-

Offering Circular 2006

Offering Circular

-

Bonds

Below you will find information on Statkraft's exchange-listed bonds.

| ISIN Code | Terms | Stock ex. | Maturity | Currency | Nominal | Coupon |

| NO0010729478 | Download | Oslo | 21.01.2027 | NOK | 300,000,000 | 2.600% |

| NO0012541442 | Download | Oslo | 14.06.2027 | NOK | 1,500,000,000 | 4.360% |

| NO0012541897 | Download | Oslo | 14.06.2032 | NOK | 3,000,000,000 | 3.930% |

| NO0012541871 | Download | Oslo | 14.06.2027 | NOK | 1,000,000,000 | 3.625% |

| NO0013256115 | Download | Oslo | 14.06.2034 | NOK | 3,750,000,000 | 4.500% |

| NO0013378844 | Download | Oslo | 22.10.2034 | NOK | 1,400,000,000 | 4.597% |

| XS1207005023 | Download | London | 26.03.2030 | EUR | 500,000,000 | 1.500 |

| XS2723597923 | Download | Dublin | 13.12.2026 | EUR | 500,000,000 | 3.125% |

| XS2532312548 | Download | Dublin | 13.09.2029 | EUR | 500,000,000 | 2.875% |

| XS2723597923 | Download | Dublin | 13.12.2031 | EUR | 500,000,000 | 3.125% |

| XS2779792337 | Download | Dublin | 22.03.2032 | EUR | 500,000,000 | 3.375% |

| XS2631822868 | Download | Dublin | 09.06.2033 | EUR | 500,000,000 | 3.500% |

| XS2779793061 | Download | Dublin | 22.03.2039 | EUR | 500,000,000 | 3.750% |

| XS2838919681 | Download | Dublin | 14.06.2034 | SEK | 500,000,000 | 3.398% |

| XS2838917479 | Download | Dublin | 14.06.2034 | SEK | 750,000,000 | 3M Stibor plus 0.53% |

|

XS2903423411 |

Download | Dublin | 17.09.2038 | SEK | 500,000,000 | 3,21% |

| XS2924022366 | Download | Dublin | 22.10.2027 | SEK | 1,400,000,000 | 3M Stibor plus 0,47% |

Green finance: Frameworks, impact reports and second opinions

The Green Finance Framework follows the ICMA 2021 Green Bond Principles and covers two eligible categories, renewable energy and energy efficiency, with a look back period of three years.

CICERO Shades of Green has rated our framework CICERO Dark Green, and the framework’s governance procedures to be Excellent.

To enable investors to follow the development and provide insight into prioritized areas, Statkraft will provide an annual Green Finance Impact Report.

Statkraft’s Green Bond Framework provides the basis for all allocations and reporting in the Green Finance Impact Report.

Green Bond is our preferred financing tool used to finance Eligible Projects that promote the transition to low carbon and climate resilient growth and a sustainable economy as determined by Statkraft.

Credit rating and analysis

Statkraft is rated by both Standard & Poor's and Fitch.

Updated 1 July 2025

| Standard & Poor's © | Fitch Ratings © | |

| Statkraft AS | ||

| Long-term rating | A- | BBB+ |

| Short-term rating | A-2 | - |

| Outlook | Stable | Stable |

| Statkraft Energi AS | ||

| Long-term rating | A- | - |

| Short-term rating | A-2 | - |

| Outlook | Stable | - |

|

Contact Standard & Poor's ©: Per Karlsson |

Contact Fitch Ratings ©: Maria Linares |

Read the latest publications from S&P Global Ratings and Fitch Ratings

Contact

André Julin

Funding Manager

Stephan Skaane

Vice President Group Treasury